A quarterly newsletter on Plastics, Logistics, and Flame Retardants

🪝China’s Economic Turmoil

🪝For a Few Antimony More

🪝Chinese New Years

Economic Uncertainty Looms: China’s Unprecedented Challenges Reshape Global Markets

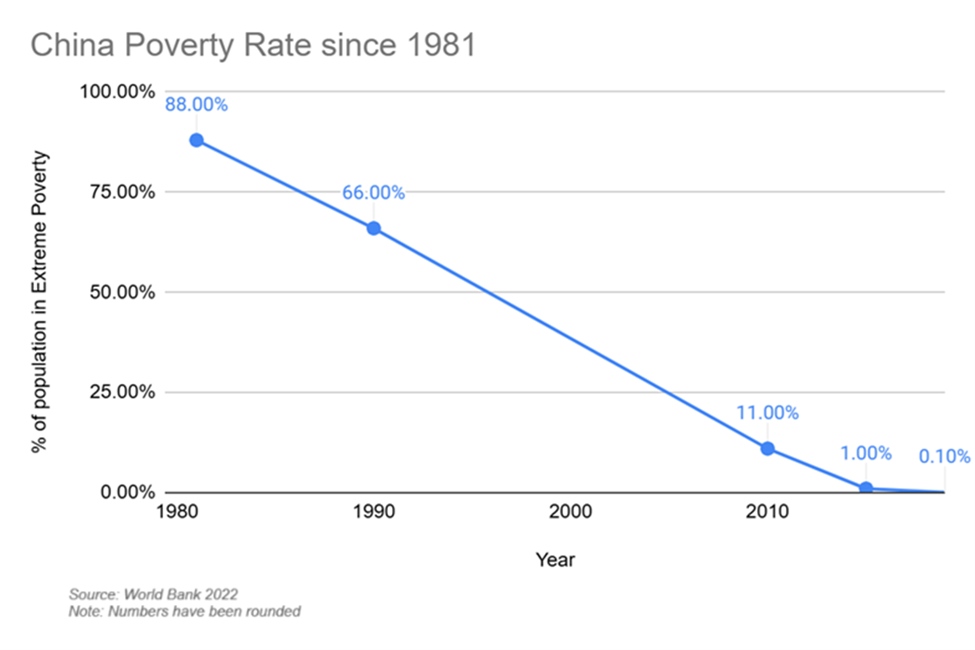

Over the past 40 years the percent of people in China living in abject poverty has declined from 88% in 1981 to below 0.1% in 2019 [1]. For additional perspective, this shift has accounted for 75% of the global reduction in the number of people living in extreme poverty. And recently, China’s middle class has grown from 3.1% of the population in 2000 to 50.8% in 2018 [2]. China is the world’s second largest economy by GDP, and continuing to grow. So what is happening in 2024?

The housing market, debt, and the response to the COVID pandemic in China have each play a part in this story.

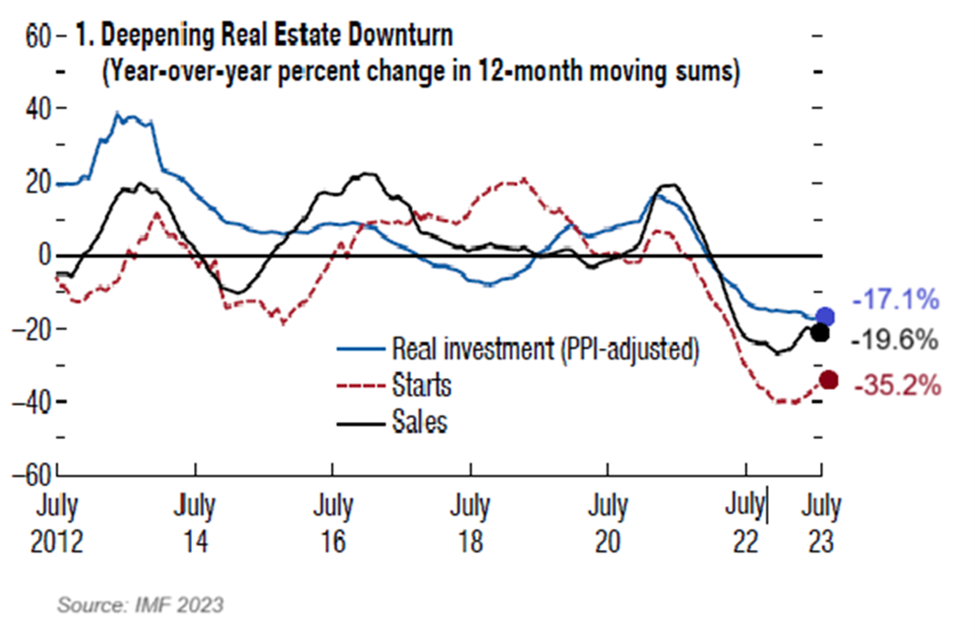

Much of this recent prosperity is thanks to the housing market, which accounts for 25-30% of the country’s GDP up until the sector’s collapse in 2021. Property sales have shrunk for the last 3 years by an average of 20% [3] and today in China there exists unsold floor space larger than the floor space of London and Manhattan combined, and likely more vacant housing than could be filled by the country’s 1.4 billion people according to a former deputy head of China’s statistics bureau [4]. China is now shifting much of this capacity through the Belt and Road Initiative to countries abroad with infrastructure needs. However, the contractions at home have amounted to an unemployment rate at a 6-month high of 5.3%, with that rate at 17.1% for urban youth.

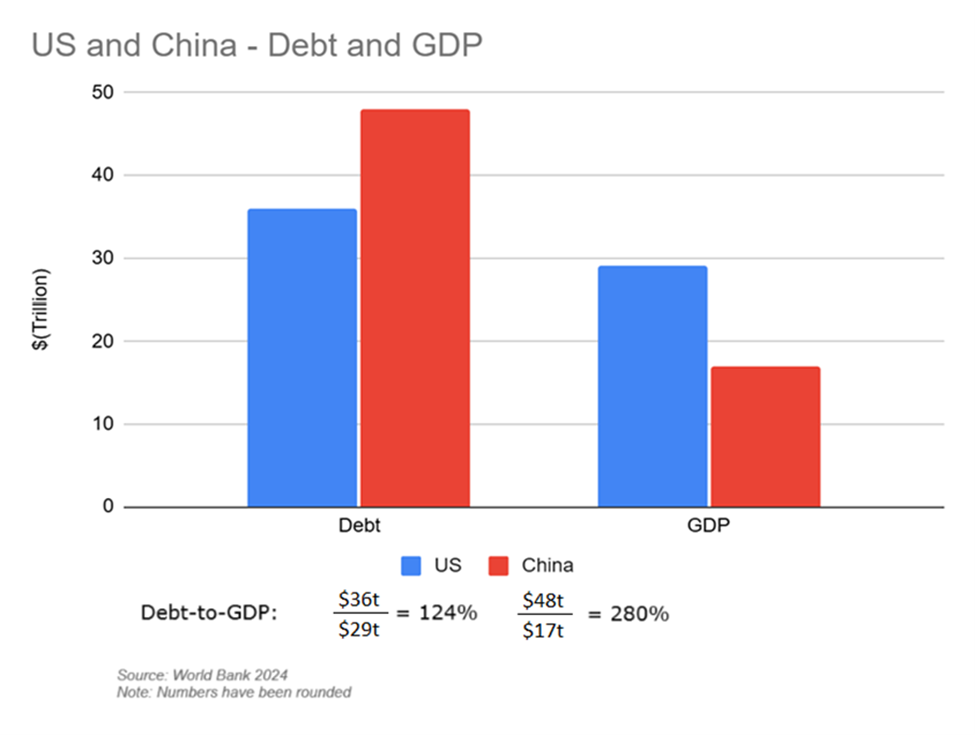

This boom in the housing sector was spurred by China’s response to the 2008 financial crisis when upwards of 13% of the country’s GDP ($555 billion) was spent on infrastructure [5]. Much of this is in the form of debt held by state and local governments banks, many of which are unable to pay their obligation today. This has caused a growing debt-to-GDP ratio, doubling since that time to a current peak of 280%, or $48 trillion compared to their $17 trillion GDP. For comparison the US nation debt is currently $36 trillion and GDP around $29 trillion, making for a 124% debt-to-GDP ratio.

COVID has also slowed China down. China’s response to the COVID Pandemic is what has been called a “zero-COVID” strategy [6], including intense lock-down restrictions on residents and closure of the borders. These restrictions only recently ended at the end of 2022 after nationwide protests of the lockdowns [7]. The restrictions have hurt consumers in China, where consumer spending is around 38% of China’s GDP, much lower than the global average of 55%. This in turn has constrained China’s economy, adding to the economic woes in recent years.

China is on a brink. The confluence of the housing market’s crash, the pilling up of debt, and the additional hindrance of COVID have created a storm in China. According to the J-curve hypothesis, introduced by American sociologist James C. Davies, social and political unrest are more likely to occur in a period of sharp economic decline after a period of sustained economic growth and improvement [8]. 70% of young adults who are unemployed hold a degree, and are overqualified for factory jobs, China’s historically dominant sector. Many educated elites are no longer confident about upward economic mobility for themselves or the next generation [9]. Since 2021 President of the PRC Xi Jinping has revived the Mao-era phrase “common prosperity.” In the 4th quarter of 2024 he approved $1.4 trillion to help the ailing economy, as well as cut interest rates and other important loan and reserve rates [10]. These actions have rallied the Shanghai Stock Exchange to gain 30% between September 13 and October 8, however it has leveled off since then. While there is optimism with the new found boost, and Goldman Sachs predicts that China will become the world’s largest economy over the US, by 2035, other economists believe China will soon peak and begin to decline.

President-elect Donald Trump has spoken on the campaign trail about raising the tariffs on Chinese imports to up to 60% from where they currently stand between 7.5% and 25% [11]. This only adds pressure to an already ailing economy in China, as some companies in the US may see business with China as untenable. This will have implications for the flame retardant market among others, and will cause prices to rise in the near- to mid-term if and when the tariff increases materialize. As your partner, we at Ocean Chemical will work with you for your best solution, even if that means purchasing with another company.

[2] https://www.pewresearch.org/global/2015/07/08/a-global-middle-class-is-more-promise-than-reality/

[5] https://www.reuters.com/breakingviews/chinas-growth-is-buried-under-great-wall-debt-2023-09-13/

[7] https://www.nytimes.com/2022/11/24/world/asia/china-unrest-covid-lockdowns.html

[8] https://louischauvel.org/DAVIES2089714.pdf

We discussed the current state of Antimony prices and restrictions in our last newsletter. And in this article we will explore the antimony market further, and implications of the export restrictions as well as the proposed tariff increases from president-elect Donald Trump.

To reiterate, Antimony is listed as a mineral critical to U.S. economic and national security by the U.S. Department of Interior, a list that includes Uranium among others [1]. Antimony is used in flame retardants, lead-acid batteries, and a variety of military applications that include explosives, and nuclear weapons.

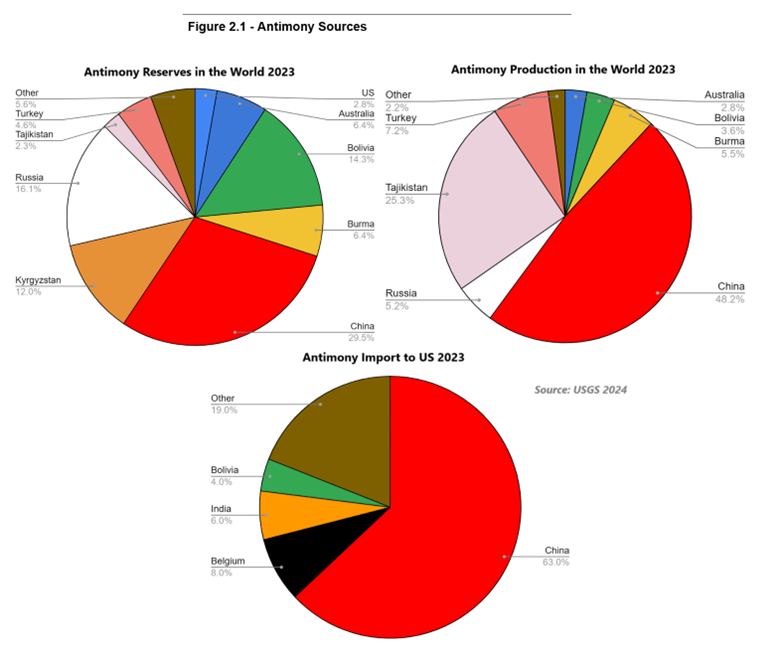

China has the largest reserves of antimony in the world, according to the US Geological Survey (USGS), as well as the largest production capacity, and is the source of 63% of the US antimony [2]. Below in Figure 2.1 is an in-depth breakdown of Antimony in the world.

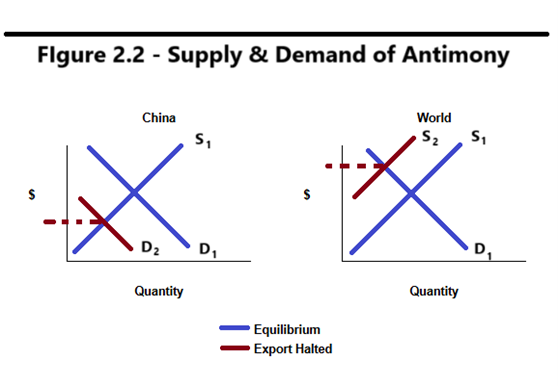

China’s export restrictions on Antimony that went into effect in September of this year 2024, subsequently caused the increase in price of Antimony and ATO to ranges of $15-$22/lb in the US. In China the price is dropping as warehouses become backed up with unsold antimony.

This state-of-affairs holds with micro-economics, where shifts in the demand curve in China is causing the price to drop, while in the rest of the world the supply curve has shifted, causing a startling increase in price. See Figure 2.2.

In the future, if the export restriction is lifted there will be a crash in the price back to a higher equilibrium price. Meanwhile the world will look elsewhere for production of antimony. The United States Department of Defense (DOD) has responded by investing $25million in Perpetua Resources to develop Stibnite mines (Stibnite abbreviated Sb is antimony), and in talks with US Antimony Corp to expand their production capacity [3][4]. United States Antimony Corp. (NYSE: UAMY) has seen their stock soar 630% in the last year, and more recently has acquired the rights to two mines in Alaska [5].

In early December the Chinese Commerce Ministry announced a new ban on the export of gallium, germanium, and antimony, along with other high-tech materials to the US in retaliation to the US Commerce department listing 140 China-based or Chinese-owned companies that will have export licenses be denied for any US company trying to do business with them. The US Commerce department action is done due to national security interests regarding semi-conductors and other AI technologies [6].

What complicates the situation further is if president-elect Donald Trump follows through on his campaign promise to increase the tariffs on Chinese imports up to 60% from where they currently stand between 7.5% and 25% [7]. Given that the rest of the world does not yet have the production capacity to fully replace China’s antimony production capabilities, the US will see higher prices for antimony and ATO in the near- and mid-term future. Ocean Chemical and their customers have seen prices ranging from $11 up to $25.

[2] https://pubs.usgs.gov/periodicals/mcs2024/mcs2024-antimony.pdf

[4] https://www.fastmarkets.com/insights/us-antimony-talks-smelter-expansion-andrea-hotter/

[6] https://apnews.com/article/china-us-tech-semiconductor-chip-gallium-6b4216551e200fb719caa6a6cc67e2a4

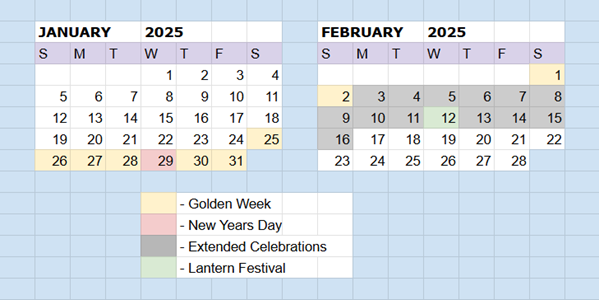

Chinese New Years in 2025 will be celebrated between Jan 25, 2025 – Feb 14, 2025 .

The main celebration of New Years Day falls on Jan 29, 2025, the day of the new moon signaling the end of Winter, and marks the start of the year of the Snake. Wikipedia’s article has more details regarding the cultural practices and history [1]. Celebrations for the new year will be held for 16 days and typically end with the Lantern Festival, which falls on Feb 12, 2025 in the upcoming year.

During these celebrations Chinese companies and exports will close down. Most companies expect to be returning Feb 3, 2025, after the Golden Week, and some will extend through the week of the Lantern Festival, returning Feb 17, 2025.

If you feel you may need material from China in February or March, you will benefit from a plan to order in early January. We at Ocean Chemical are standing by to make the logistics journey with you!