🪝NATIONAL PLASTICS EXPO (NPE) 2024

🪝DUTY/TARIFF VIOLATIONS

🪝FREIGHT UPDATES

NPE2024: The Global Plastics Innovation Showcase

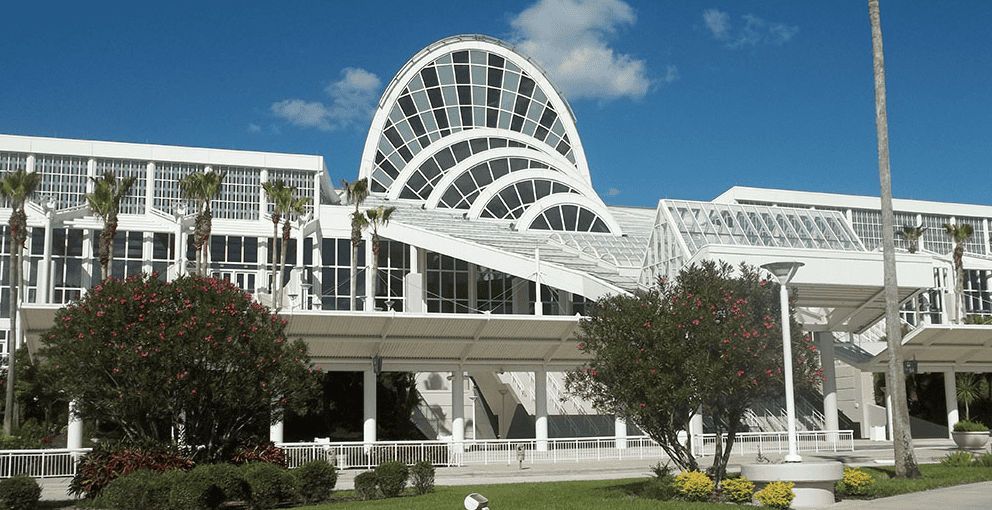

Get ready for the biggest plastics event in the Americas! NPE2024: The Plastics Show is taking over the Orange County Convention Center in Orlando from May 6-10, 2024. This massive trade show is the premier stage for groundbreaking innovations across every sector of the $600 billion+ plastics industry.

With mind-blowing innovations and future-focused insights all under one roof, NPE2024 is an absolute must-attend for anyone working in the plastics realm. In addition to over 1 million square feet of exhibit space showcasing the latest products from 2,000+ companies, NPE offers over 100 sessions and workshops led by global leaders. Key topics include the circular economy, recycled plastics, AI/automation, workforce trends, and sector-specific updates for automotive, healthcare, consumer goods and more. With 55,000+ attendees from 110+ countries, it’s also a prime networking hub to unveil new offerings and forge international partnerships.

For More Information Visit the NPE website: https://npe.org/

The Exhibitor List: https://npe.org/exhibitor-list/

The Tech Zones: https://npe.org/tech-zones/

Date: May 6-10, 2024

Location: Orlando, Florida, USA

Ocean Chemical will be attending the NPE! Contact us to see when we can best meet.

Protecting Your Business and Upholding Fair Trade Practices

In recent years, there has been a disturbing rise in importers using shady transshipment and misclassification tactics to evade antidumping duties, countervailing duties, and Section 301 tariffs – especially on chemicals like citric acid, sodium gluconate, and xanthan gum from China. Transshipment involves rerouting Chinese products through third-party countries and falsely labeling them as originating from those nations to dodge duties. Misclassification means deliberately misidentifying products to exclude them from tariff orders. Both are fraudulent maneuvers that undermine fair trade.

Recent cases underscore the government’s intensifying crackdown on duty evasion schemes. In March 2024, a New Jersey importer pleaded guilty to mislabeling $1.4 million worth of hazardous Chinese chemicals and agreed to pay $3.1 million for evading duties through falsified documents. That same month, U.S. Customs launched a probe into whether an importer transshipped xanthan gum from China through Israel to sidestep antidumping duties.

We at Ocean Chemical strive to conduct our business with the utmost integrity when it comes to trade compliance. We will never participate in duty evasion that cheats the system and compromises ethical business standards. By remaining vigilant and upholding fair trade principles, we can level the playing field and promote an equitable global marketplace.

Customs and Border Patrol EAPA Allegations:

https://www.cbp.gov/trade/trade-enforcement/tftea/eapa

Penta Settlement

Guy & O’Neil Investigation Commencement

Ocean Freight: Navigating the Ebb and Flow

As the traditional slow season kicks in on major trade lanes, ocean carriers are adjusting capacity through blank sailings and service reshuffles to balance supply and demand. Meanwhile, the major alliances are undergoing a shakeup – the Ocean Alliance has been extended through 2032, while the new Gemini Alliance between Maersk and Hapag-Lloyd launches in early 2025. On the Asia trades, spot rates continue softening despite ongoing Suez disruptions, with the April 1 rate increase providing only temporary reprieve as significant capacity increases may keep rates volatile to North Europe.

All eyes are on upcoming labor talks in North America, with potential rail disruptions in Canada by late May and concerns over stalled ILA negotiations that could trigger an October strike on the U.S. East/Gulf coasts. On the export side, Asian transshipment hub congestion is causing 2-week delays. The fluid Suez situation is absorbing 6-9% of global capacity, while U.S. import volumes surged over 15% year-over-year in March. The Panama Canal is increasing slot capacity to ease disruptions.

Latin American demand remains robust at 80-90% utilization, though port congestion plagues areas like Brazil. Oceania is contending with disruptions and service changes. The Middle East/South Asia face equipment shortages on delayed sailings. Rate levels may drop on some trades if overcapacity persists. Despite headwinds, the market landscape remains dynamic. Shippers must stay nimble and seek strategic partnerships to navigate the ebb and flow.

For More Information Visit C.H. Robinson’s website:

Transportation Market Insights and Advisories

C.H. Robinson did not pay for this promotion

Thanks for reading! If you found this insightful please share this with your colleagues.

Find us on LinkedIn!